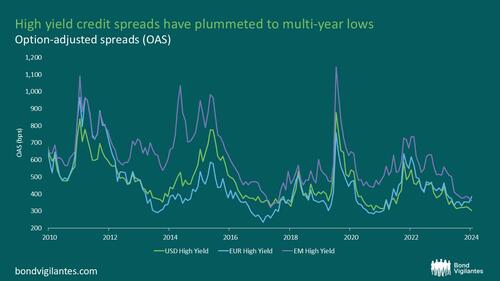

High Yield Bonds: Excess Spread Vs Excess Optimism? Authored by Charles de Quinsonas via BondVigilantes.com, With the US Treasury curve yielding above 4%, high yield (HY) bonds still offer mid-single digit yields. As of the end of September, US high yield, European high yield and emerging markets (EM) corporate high yield bonds were offering 7.0%, 6.1% and 7.4% respectively. Credit spreads, however, have plummeted to multi-year lows and the eternal debate between all-in yield vs credit spreads continues. Source: M&G, BofA Global Research, as at 30 September 2024 Credit spreads matter because, at an index level, they need to overcompensate… — Continue at ZeroHedge News : Read More

Home » High Yield Bonds: Excess Spread Vs Excess Optimism? – Tyler Durden

High Yield Bonds: Excess Spread Vs Excess Optimism? – Tyler Durden