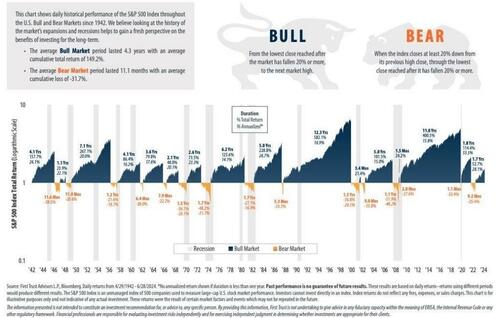

Market Declines And The Problem Of Time Authored by Lance Roberts via RealInvestmentAdvice.com, When stock markets rise, the bullish narrative tends to dominate, overlooking the potential impact of market declines. This oversight stems from two main problems: a basic misunderstanding of math and time’s critical role in investing. Every year, I receive the following chart as a counterargument when discussing the importance of managing risk during a portfolio’s life cycle. The chart shows that while the average bull market advance is 149%, the average bear market decline is just -32%. So, why bother managing risk when markets rise 4.7x more… — Continue at ZeroHedge News : Read More

Home » Market Declines And The Problem Of Time – Tyler Durden

Market Declines And The Problem Of Time – Tyler Durden