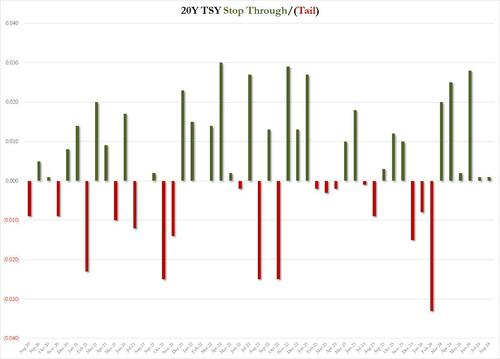

20Y Auction Sees Lackluster Demand Despite 6th Consecutive Stop Through In a day when the markets have tried to make sense of today’s near record downward revision to payrolls, moments ago the US sold $16BN in 20Y paper, and despite the prevailing confusion (does the dire BLS data confirm a 50bps rate cut, or do we stick with 25bps), there were plenty of buyers, even if the auction metrics were not remarkable by any stretch. The auction, which passed without a hitch, sold at a high yield of 4.16%, which was 30bps below last month’s 4.466%, and the lowest yield… — Continue at ZeroHedge News : Read More

Home » 20Y Auction Sees Lackluster Demand Despite 6th Consecutive Stop Through – Tyler Durden

20Y Auction Sees Lackluster Demand Despite 6th Consecutive Stop Through – Tyler Durden