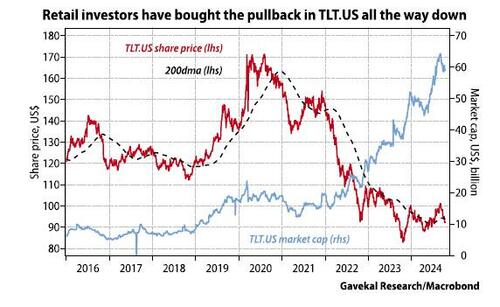

Behind The Bond Sell-Off Authored by Louis-Vincent Gave via Evergreen Gavekal blog, TLT.US, the long-dated US treasury ETF, is back trading below its 200-day moving average, and on current form is looking at its fourth year running of negative price returns. Not that this sell-off reflects any lack of retail investor enthusiasm for US bonds. Quite the contrary. As US treasuries pulled back, flows into TLT.US went parabolic – and the ETF’s market cap rose from US$10bn in 2019 to US$60bn today. But long-dated bonds continue to sell off. And like successes, sell-offs usually have many fathers. When it comes… — Continue at ZeroHedge News : Read More