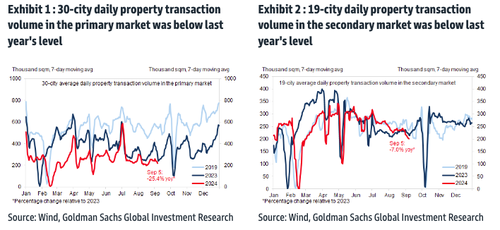

High-Frequency Indicators Provide Clear Snapshot Of China’s Dismal Recovery A deepening property crisis and sluggish consumer spending derailed China’s economic recovery by late summer. Last week, Bloomberg Market Live reporters noted that soft corporate earnings signaled the world’s second-largest economy is “nowhere close to bottoming out.” Goldman analysts led by Yuting Yang and Lisheng Wang recently published a client note highlighting that high-frequency economic indicators, including consumption and mobility; production and investment; other macro activity, and markets and policy, reveal continued souring conditions in China. The big takeaway from the high-frequency economic indicators is that the property sector has yet to stabilize to end the vicious spiral… — Continue at ZeroHedge News : Read More

Home » High-Frequency Indicators Provide Clear Snapshot Of China’s Dismal Recovery – Tyler Durden

High-Frequency Indicators Provide Clear Snapshot Of China’s Dismal Recovery – Tyler Durden