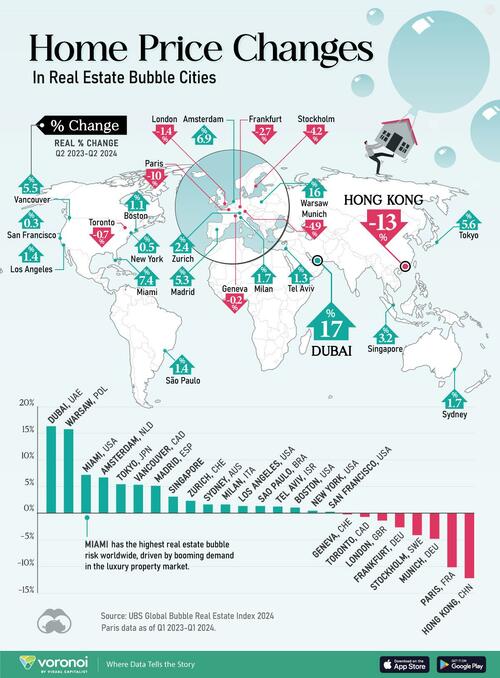

Mapping Real Home Price Changes In Bubble Markets Since mid-2022, housing prices in the world’s real estate bubble cities have sunk approximately 15% in real terms as central banks embarked on rate hikes Many European cities are experiencing the steepest declines amid stagnating population growth and weaker economic activity. On the flip side, bubble markets like Dubai, Miami, and Tokyo have seen sustained price increases driven by population growth and demand in the luxury sector. This graphic, via Visual Capitalist’s Dorothy Neufeld, shows the annual change in real home prices across housing bubble cities, based on data from UBS’ Global Real… — Continue at ZeroHedge News : Read More

Home » Mapping Real Home Price Changes In Bubble Markets – Tyler Durden

Mapping Real Home Price Changes In Bubble Markets – Tyler Durden