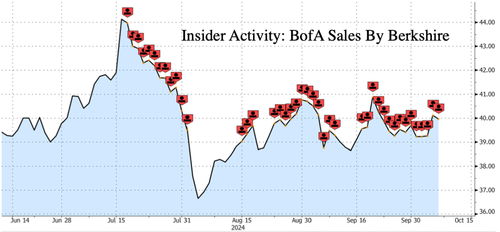

Warren Buffett’s BofA Dump-A-Thon Tops $10 Billion, Nears Key 10% Non-Reporting Level 94-year-old Warren Buffett’s Berkshire Hathaway has been on a multi-month dump-a-thon of Bank of America shares. The reason for the abrupt selling, which began in mid-July, has yet to be officially disclosed but should be viewed as an ominous sign that the ‘Oracle of Omaha’ foresees economic trouble ahead. The latest Bloomberg data shows that Berkshire’s total proceeds from selling BofA shares have now topped a whopping $10bln. Traders at Berkshire began paring down the massive investment in mid-July, pressuring the bank’s shares ever since. In the last three trading days, Berkshire sold… — Continue at ZeroHedge News : Read More

Home » Warren Buffett’s BofA Dump-A-Thon Tops $10 Billion, Nears Key 10% Non-Reporting Level – Tyler Durden

Warren Buffett’s BofA Dump-A-Thon Tops $10 Billion, Nears Key 10% Non-Reporting Level – Tyler Durden