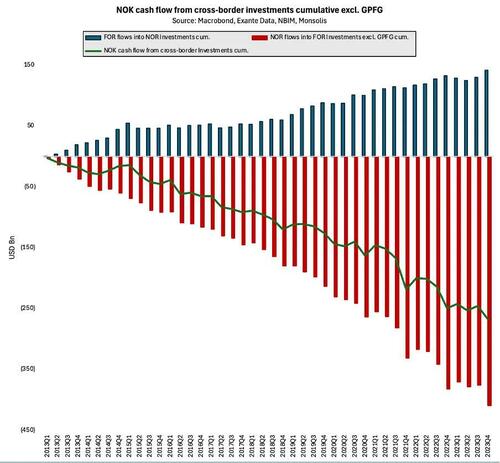

We Cannot Have Monetary Policy Based On Luck By Tor Vollalokken. The blog appeared earlier this month as an op-ed in Dagens Næringsliv. Tor Vollalokken enjoyed more than fifteen years as an Investment Banker and thirty years as an independent analyst and advisor to sovereigns, hedge funds, fund managers, family offices, and energy companies worldwide, focusing on Scandinavian currencies. NOK’s structural challenge The weakening of the krona in recent years is, for me, explained through two structural factors: 1. A large capital outflow in kroner is caused by an import surplus in the goods trade balance (the petroleum sector is… — Continue at ZeroHedge News : Read More