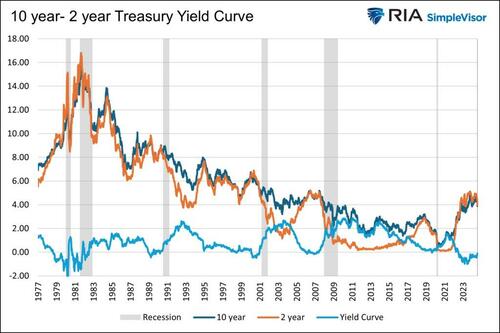

Yield Curve Shifts Offer Signals For Stockholders Authored by Michael Lebowitz via RealInvestmentAdvice.com, The level of U.S. Treasury yields and the changing shape of the Treasury yield curve provide investors with critical feedback regarding the market’s expectations for economic growth, inflation, and monetary policy. Short- and long-term yields have recently fallen, with short-term maturities leading the charge. The changes result in what bond traders call a bull steepening yield curve shift. The shift is due to weakening economic conditions, moderating inflation, and the increasing likelihood that the Fed will lower rates. Yield curves are essential indicators that bond investors closely… — Continue at ZeroHedge News : Read More

Home » Yield Curve Shifts Offer Signals For Stockholders – Tyler Durden

Yield Curve Shifts Offer Signals For Stockholders – Tyler Durden