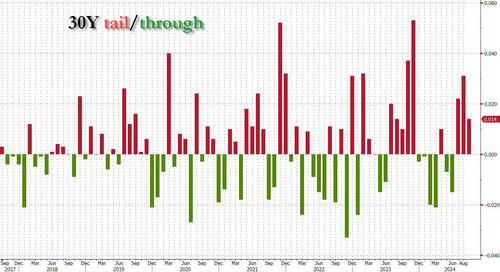

YIelds Hit Session High After Tailing 30Y Auction After two stellar auctions, where both Tuesday’s 3Y and yesterday’s 10Y sale may have been two of the best auctions in history for the respective tenors, moments ago the Treasury concluded the week’s coupon issuance when it sold $22BN in 30Y paper in a decidedly uglier sale. The auction stopped with a high yield of 4.015%, 30bps below last month’s stop and the lowest since July 2023, but the auction also tailed the When Issued 4.001 by 1.4bps, the 3rd consecutive tail in a row. The bid to cover was 2.376, a… — Continue at ZeroHedge News : Read More

Home » YIelds Hit Session High After Tailing 30Y Auction – Tyler Durden

YIelds Hit Session High After Tailing 30Y Auction – Tyler Durden